Shares of General Motors Co. rallied Friday, putting them on track to snap a five-session losing streak, after a bullish call from Wedbush analyst Dan Ives, who said the automobile maker is now a “disruptive technology play” given Chief Executive Mary Barra’s “laser focus” on electric vehicles.

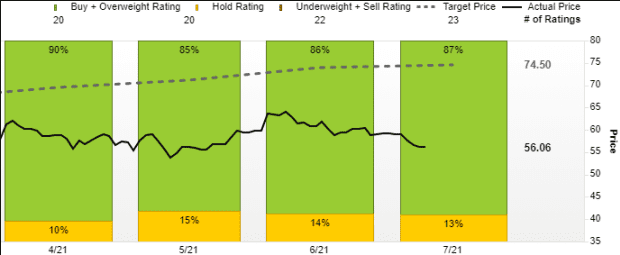

Ives initiated coverage of GM with an outperform rating and an $85 stock-price target, which implies a 52% gain from Thursday’s closing price of $56.06. That makes Ives the second most bullish of the 23 Wall Street analysts surveyed by FactSet, behind only Wolfe Research’s Rod Lache, who has an $86 price target.

The stock GM, +4.82% rose 3.6% in premarket trading Friday, after falling 5.3% over the past five trading sessions. It closed Thursday at a seven-week low.

20 of 23 analysts who cover GM are bullish

FactSet

With at least 20 new EV models coming out in the next two years, and 30 EV models in the next three years, Ives said, “2021 serves as an inflection point” for GM, as it completely shift its focus toward an electric future.

“Going forward, GM continues to be a re-rating story as the Street treats the Detroit automaker no longer as a traditional auto company trading based on book value, but a broader disruptive technology play that can start to trade at multiples similar to the likes of Tesla and other pure-play electric-vehicle companies as GM executes on its vision,” Ives wrote in a note to clients.

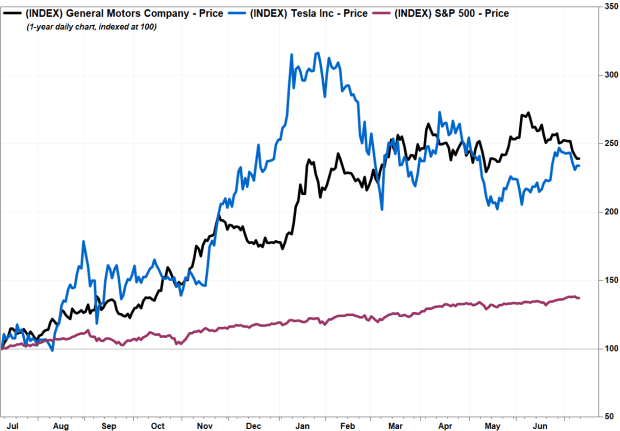

GM’s stock has climbed 34.6% to date in 2021 and has run up 139.4% over the past 12 months through Thursday, to outperform Tesla Inc.’s stock TSLA, +0.63%, which has lost 7.5% this year but advanced 134.1% over the past year. In comparison, the S&P 500 index SPX, +1.13% has advanced 15% in 2021 and has climbed 37.1% over the past 12 months.

Ives said that with GM developing “game changing” battery technology under the Ultium Platform, the company is also in a “great position” to take advantage of an emerging $5 trillion battery market over the next decade.

“By leveraging this technology, the legacy auto [manufacturer] will be able to eat up market share against pure-play EVs in all aspects of the industry,” Ives wrote.

But that’s not all. Ives said GM’s software and services business attached to the EV shift, as autonomous- and assisted-driving capabilities and battery technology improve, represents “a potential gold mine” that could bring in $20 billon to $30 billion over the next five to seven years.

from WordPress https://ift.tt/3yHWFuh

via IFTTT

No comments:

Post a Comment