Uniswap is not even three years old, but it has already turned millions of dollars into billions for venture capitalists who bet on a new kind of cryptocurrency exchange.

Instead of acting as a traditional broker, Uniswap is an automated software program that allows users to trade cryptocurrencies directly with each other, without any intermediary.

Last year venture capitalists who had invested a total of $12.8m in the company behind the project received a sweetener: Uniswap began distributing 1bn digital tokens to users, giving investors 18 per cent of the total.

The tokens, which give holders voting rights in the project, have surged to a price of $28, rewarding the investors with a stake worth roughly $5bn were all the tokens issued. Uniswap has outlined a four-year vesting schedule for the tokens, which currently have a market capitalisation of about $16bn, according to CoinMarketCap data.

Uniswap has plenty of company. In the past year, the fastest-growing cryptocurrency start-ups have been those aiming to abolish financial intermediaries. They have also brought along a new crop of venture capitalists, producing returns that are the envy of more conservative peers.

Decentralised finance, or “DeFi”, projects aim to replicate basic financial services such as lending and trading using software programs known as blockchains, cutting out traditional middlemen.

In the span of two years, and aided by the recent cryptocurrency boom, what started as a curiosity has ballooned in size, ushering in a new model for technology investing in the process.

Private investors have backed 72 DeFi companies this year, according to PitchBook data, already surpassing last year’s total by more than a quarter.

Uniswap facilitated more than $1bn in trading on a majority of the days in May, rivalling traditional cryptocurrency exchanges such as Coinbase for business in ether and other related tokens.

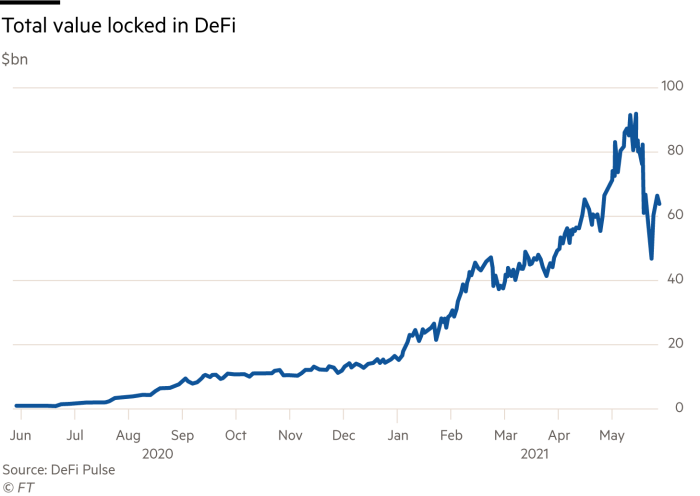

Meanwhile, the value of cryptocurrency being used as collateral for loans, trades and other transactions in DeFi applications has increased by a factor of more than 60 in the past year, rising to the equivalent of more than $67bn, according to data from the website DeFi Pulse.

Backers of DeFi projects are confident that in the long term, the applications stand a good chance of rewiring the financial system.

But traditional venture capital firms, including Sequoia Capital, have largely avoided investing directly in DeFi projects, partly because of concerns about how they would be treated by regulators, according to people familiar with their thinking.

Lawyers and venture capitalists said DeFi inhabits a largely unregulated grey area that could face pressure from the new Securities and Exchange Commission chair Gary Gensler. Some investors drew comparisons between DeFi and the boom in initial coin offerings four years ago, which collapsed following interventions by regulators.

“The fundamental structure of US financial regulation is through intermediaries,” said Jai Massari, a partner at the law firm Davis Polk who advises on cryptocurrency transactions. “Here, you don’t have those intermediaries.”

Sequoia and other traditional venture firms have instead invested at arm’s length through specialist cryptocurrency funds, which often have more flexible structures that allow them to amass larger stakes in digital assets. Paradigm and Polychain Capital, two large investors in DeFi projects, have both received investments from Sequoia.

The Harvard and Yale university endowments have also backed Paradigm, which is led by Coinbase co-founder Fred Ehrsam and former Sequoia partner Matt Huang. After raising $740m beginning in 2018, the firm’s assets had swelled to $3bn by the end of last year, according to regulatory filings.

Larger funds are on the way. Andreessen Horowitz, an investor in several of the largest DeFi projects such as lending programs Compound and Maker, has recently sought to raise $1bn for the next version of its cryptocurrency funds, almost doubling the size of its most recent version.

Not everybody in DeFi has welcomed venture capitalists, who often receive preferential terms for investing early. One project, PoolTogether, altered the terms of a planned token deal after some community members complained about the discount the investors would receive in exchange for providing speedy funding, according to the group’s online forums.

“The signalling that would otherwise be really valuable from having an A-tier investor — it has an inverse effect in DeFi,” said Haseeb Qureshi, managing partner at Dragonfly Capital, a cryptocurrency venture firm.

Weekly newsletter

For the latest news and views on fintech from the FT’s network of correspondents around the world, sign up to our weekly newsletter #fintechFT

While DeFi groups often begin as companies that raise traditional venture capital, the real payout comes when the projects issue large pools of tokens.

The distributions, which reward users with effectively free assets for their participation in the networks, are meant to spread governance rights to a broad group, lessening the power of founders over time. They have also paid off handsomely for venture capitalists.

If Uniswap’s tokens continue to trade at current levels, venture capitalists will have returned almost 400 times their initial capital in the project by the time their shares have fully vested.

Paradigm, which led a $1.8m round of seed funding in the company behind Uniswap, was the largest outside investor when the project began issuing tokens last year, said two people familiar with the matter. The firm had received the rights to its share of any tokens issued by the project when it invested, one of the people said. Paradigm and Uniswap both declined to comment.

Some investors have already begun placing bets on alternative venues for DeFi developers. Ethereum, the blockchain underlying most of the projects, has struggled with high transaction costs as volume has surged, frustrating traders.

Kyle Samani, managing partner of Multicoin Capital, said investors had placed too much confidence in Uniswap becoming the dominant market maker and ethereum remaining the most important computing program for DeFi.

Solana, a new blockchain that Multicoin backed in 2019, has appreciated by a factor of more than 150 since it listed on the exchange Binance last year, giving it a market capitalisation of $9.1bn. Multicoin is the largest outside investor in the project, the two groups said. Solana claims it has faster speeds and lower transaction costs than ethereum.

“By the end of the year, the smartest money that’s not full-time crypto will be saying ethereum has not won,” Samani said.

from WordPress https://ift.tt/2RoKR04

via IFTTT

No comments:

Post a Comment