The recent volatility in bitcoin prices triggered by Tesla’s Elon Musk has raised new doubts among institutional fund managers over the future of cryptocurrencies as an asset class.

UBS Wealth Management, Pimco, T Rowe Price and Glenmede Investment Management were among the firms that have expressed reservations in recent days about the potential of cryptocurrency investments.

The upheaval came after Tesla said it would no longer accept payment in bitcoin for its electric vehicles owing to environmental concerns, and Musk jokingly referred to dogecoin, a rival cryptocurrency, as a “hustle” during an appearance on the Saturday Night Live television show.

“Our stance with clients is the 10-foot pole rule: stay away from it,” said Jason Pride, chief investment officer of private wealth at Glenmede. “I don’t think the Fed and other regulators are fans of the current market structure for cryptocurrencies.”

Rob Sharps, president and head of investments at T Rowe Price, told the Financial Times: “Crypto has an impact across capital markets, and we’re capital markets experts. Ultimately, the mandates we manage for clients are not well suited for investing in cryptocurrencies, and we recognise the high level of speculation in this space.”

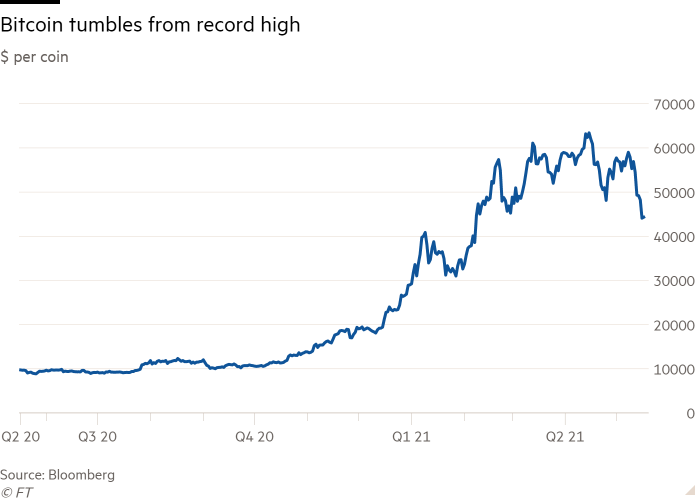

Highlighting the extreme volatility, bitcoin traded at just above $44,000 on Monday, down about $20,000 from the record high it hit just a month ago. The latest tumult was sparked by Musk seeming to imply on Twitter that Tesla has or will sell the stake it has accumulated in bitcoin. He later clarified that the automaker “has not sold any bitcoin”.

To be sure, bitcoin has gained ground with investors in recent years and trading in futures contracts has become more liquid. US regulators are also considering whether to approve crypto exchange traded funds.

But asset managers say they are troubled by signs that cryptocurrencies are failing to live up to expectations that they would become less volatile over time or offer investors hedges against equity turbulence or inflation.

“The volatility of crypto is stratospherically high and we often see that, when equities sell off, so does bitcoin and that means it is not a good portfolio diversifier,” Pride said.

Nicholas Johnson, portfolio manager for commodities at Pimco, took issue with bitcoin advocates who praised it as an inflation haven after cryptocurrencies rallied while gold fell in price.

“This idea that crypto is an inflation asset is curious,” he said. “Inflation assets underperformed in recent years while cryptocurrencies did very well. People are looking for a reason to justify why crypto has gone up.”

Cryptocurrency anxieties were further exacerbated this week when a leading US regulator warned investors that buying mutual funds with exposure to bitcoin futures “is a highly speculative investment” — and warned mutual funds that it would be subjecting their involvement with the cryptocurrency to intense scrutiny.

The Division of Investment Management at the Securities and Exchange Commission said: “Investment in the bitcoin futures market should be pursued only by mutual funds with appropriate strategies that support this type of investment and full disclosure of material risks.”

“We expect more stringent policy and regulatory controls ahead for crypto as it becomes more mainstream,” UBS Wealth Management said, adding that the price volatility that followed the Tesla announcement “highlights risks companies face if they take on crypto balance sheet exposure”.

Tom Jessop, head of digital assets at Fidelity, which has been more receptive to cryptocurrencies, nevertheless cautioned that such investments were still in the early stage of development.

“We refer to bitcoin as an aspirational store of value and it’s an adolescent in terms of its development due to the extreme volatility,” he said. “Some investors are willing to accept the volatility as they see bitcoin as a long-term venture opportunity.”

Fidelity provides a brokerage service that enables more than 100 institutional investors such as hedge funds and family offices to buy cryptocurrencies and offers them custodian services. Fidelity has a small fund that invests in digital assets for clients and its has applied to the SEC to launch an ETF for bitcoin.

Even if asset managers shy away from crypto, swings in its valuations are a concern for the industry because of the growing power of retail traders to cause volatility in the equity market, known as the “substitution effect”.

“Watching what retail investors are doing is as important as bond flows to managers now,” said Viraj Patel, an analyst at Vanda Research. “They are asking, if millennial capital is buying bitcoin, does this mean they’re going to stop buying high-beta US stocks?”

Weekly newsletter

For the latest news and views on fintech from the FT’s network of correspondents around the world, sign up to our weekly newsletter #fintechFT

from WordPress https://ift.tt/3ygd3m9

via IFTTT

No comments:

Post a Comment